Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

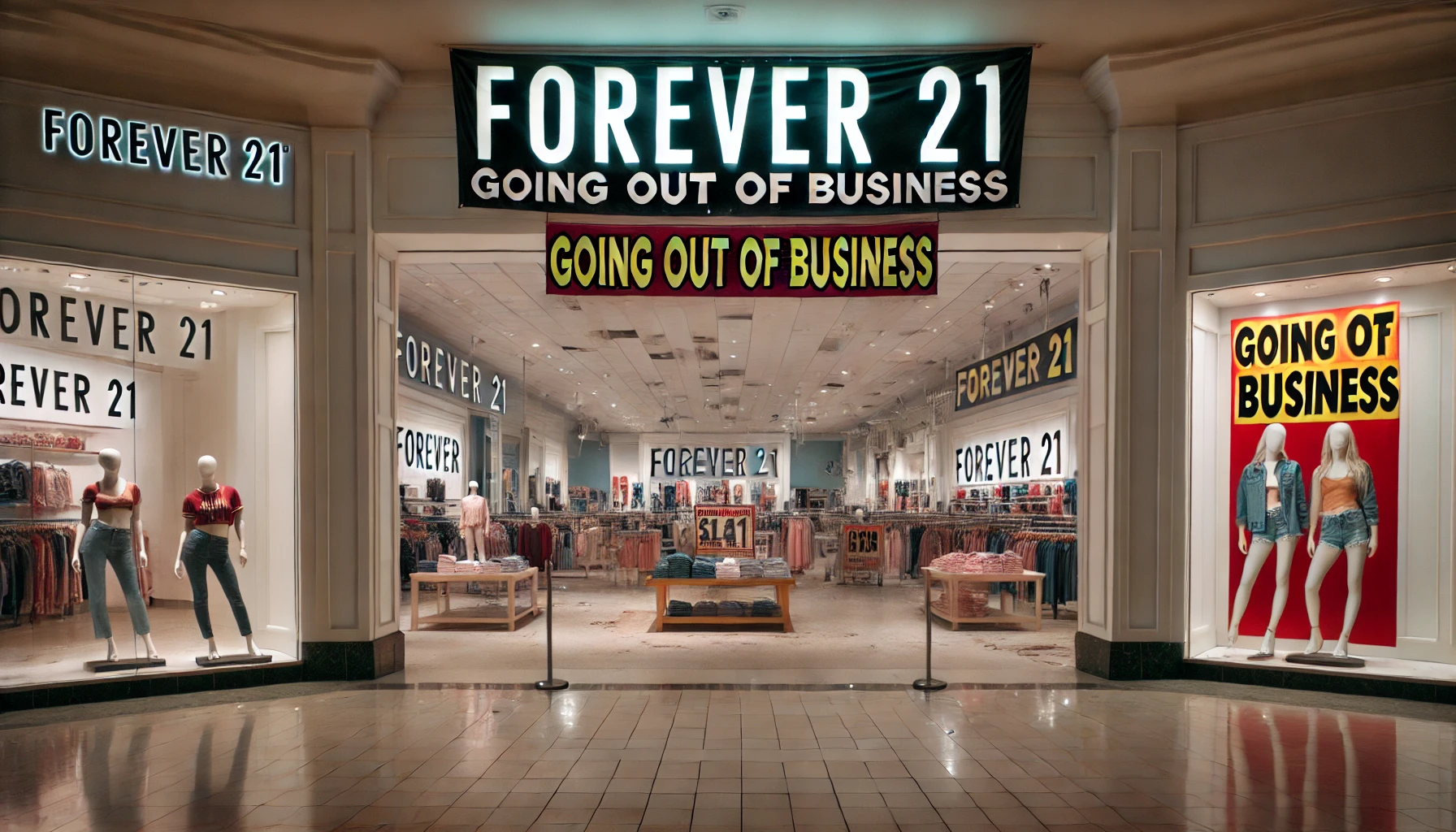

Forever 21 has filed for Chapter 11 bankruptcy on March 16, 2025, marking its second bankruptcy in six years. The once-dominant fast-fashion retailer is shutting down all 354 U.S. stores due to rising competition from Shein and Temu, declining mall traffic, and high operational costs. Learn about Forever 21's financial struggles, liquidation plans, and the future of the brand in this in-depth analysis.

Forever 21, a giant in the fast-fashion industry, has once again filed for Chapter 11 bankruptcy, with reports confirming the filing took place on March 16, 2025. This marks the second bankruptcy filing in six years, underscoring the continued challenges faced by traditional retail in an era of digital transformation. With plans to wind down U.S. operations and liquidate all 354 stores, this development represents a potential end for Forever 21’s physical presence in the United States. However, the brand’s intellectual property may still be valuable, leading to future opportunities.

This long-form analysis delves into the factors leading to Forever 21’s decline, the implications of the bankruptcy, and the broader lessons for the retail industry.

Founded in 1984 by Do Won Chang and Jin Sook Chang, Forever 21 quickly became one of the most recognizable names in fast fashion. The brand’s ability to deliver affordable, trendy clothing made it a favorite among young shoppers. At its peak, Forever 21 had over 800 stores worldwide, generating billions in revenue.

However, the retail landscape began shifting dramatically in the 2010s, as digital-first retailers like Shein, ASOS, and Fashion Nova gained market share. Forever 21’s reliance on large physical stores, often in struggling malls, put it at a disadvantage as consumer behavior shifted toward online shopping.

Forever 21’s first Chapter 11 bankruptcy filing came in September 2019 as the company faced declining mall traffic, rising rental costs, and e-commerce competition. The filing led to:

The restructuring allowed the company to continue operations under a joint venture called Sparc Group, but many of the underlying challenges remained unresolved.

On March 16, 2025, Forever 21’s U.S. operating company, F21 OpCo, filed for Chapter 11 bankruptcy protection in a Delaware court. The filing was confirmed by multiple reports on March 17, 2025, from sources like Reuters, CNN, and Fox Business. The company announced plans to liquidate assets and shut down all U.S. stores.

Forever 21’s financial downfall is attributed to several key factors:

Forever 21 announced that it would conduct closing sales at all 354 U.S. stores while keeping its website operational for a short period to liquidate remaining inventory. Industry analysts predict most locations will close by mid-2025.

Forever 21’s struggles are part of a broader trend affecting brick-and-mortar retail, often referred to as the “retail apocalypse.”

| Aspect | 2019 Filing | 2025 Filing |

|---|---|---|

| Date | September 29, 2019 | March 16, 2025 |

| Stores Affected | 178 U.S. stores closed, 350 globally | All 354 U.S. stores expected to close |

| Financing Secured | $275M from existing lenders, $75M new capital | Not specified in reports |

| International Impact | Ceased operations in 40 countries | Focus on U.S. liquidation |

| Outcome | Sold to new owners, continued operations | Seeking buyer, likely liquidation |

This comparison highlights that while the 2019 bankruptcy was an attempt at restructuring, the 2025 filing indicates a more severe financial collapse.

While Forever 21’s U.S. stores are expected to close, its brand may continue to exist in some capacity:

Forever 21’s decline offers valuable insights for other retailers:

Forever 21’s March 16, 2025, bankruptcy filing marks a turning point in U.S. retail, potentially ending the company’s physical store operations. The filing highlights the challenges facing legacy retailers in an era dominated by digital-first brands. While Forever 21’s intellectual property may continue under new ownership, its failure to adapt to e-commerce trends, rising competition, and shifting consumer behavior ultimately led to its downfall.

This case study serves as a warning for traditional retailers, emphasizing the need for innovation, agility, and a strong digital presence to survive in today’s fast-changing retail landscape.